Efficient approximate Bayesian inference for Structural Equation Models.

While Markov Chain Monte Carlo (MCMC) methods remain the gold standard for exact Bayesian inference, they can be prohibitively slow for iterative model development. INLAvaan offers a rapid alternative for latent variable analysis, delivering Bayesian results at (or near) the speed of frequentist estimators. It achieves this through a custom, ground-up implementation of the Integrated Nested Laplace Approximation (INLA), engineered specifically for the lavaan modelling framework.

A familiar interface

INLAvaan is designed to fit seamlessly into your existing workflow. If you are familiar with the (b)lavaan syntax, you can begin using INLAvaan immediately.

As a first impression of the package, consider the canonical example of SEM applied to the Industrialisation and Political Democracy data set of Bollen (1989)1:

library(INLAvaan)

model <- "

# Latent variable definitions

ind60 =~ x1 + x2 + x3

dem60 =~ y1 + y2 + y3

dem65 =~ y5 + y6 + y7 + y8

# Latent regressions

dem60 ~ ind60

dem65 ~ ind60 + dem60

# Residual correlations

y1 ~~ y5

y2 ~~ y4 + y6

y3 ~~ y7

y4 ~~ y8

y6 ~~ y8

# Fixed loading

dem60 =~ 1.5*y4

# Custom priors on latent variances

ind60 ~~ prior('gamma(1, 1)')*ind60

dem60 ~~ prior('gamma(2, 1)')*dem60

dem65 ~~ prior('gamma(1,.5)')*dem65

"

utils::data("PoliticalDemocracy", package = "lavaan")

fit <- asem(model, PoliticalDemocracy)

#> ℹ Finding posterior mode.

#> ✔ Finding posterior mode. [35ms]

#>

#> ℹ Computing the Hessian.

#> ✔ Computing the Hessian. [92ms]

#>

#> ℹ Performing VB correction.

#> ✔ VB correction; mean |δ| = 0.035σ. [84ms]

#>

#> ⠙ Fitting skew normal to 0/30 marginals.

#> ⠹ Fitting skew normal to 6/30 marginals.

#> ⠸ Fitting skew normal to 18/30 marginals.

#> ⠼ Fitting skew normal to 29/30 marginals.

#> ✔ Fitting skew normal to 30/30 marginals. [549ms]

#>

#> ℹ Sampling covariances and defined parameters.

#> ✔ Sampling covariances and defined parameters. [59ms]

#>

#> ⠙ Computing ppp and DIC.

#> ⠹ Computing ppp and DIC.

#> ✔ Computing ppp and DIC. [192ms]

#>

summary(fit)

#> INLAvaan 0.2.3 ended normally after 80 iterations

#>

#> Estimator BAYES

#> Optimization method NLMINB

#> Number of model parameters 30

#>

#> Number of observations 75

#>

#> Model Test (User Model):

#>

#> Marginal log-likelihood -1651.231

#> PPP (Chi-square) 0.170

#>

#> Information Criteria:

#>

#> Deviance (DIC) 3214.887

#> Effective parameters (pD) 58.157

#>

#> Parameter Estimates:

#>

#> Marginalisation method SKEWNORM

#> VB correction TRUE

#>

#> Latent Variables:

#> Estimate SD 2.5% 97.5% NMAD Prior

#> ind60 =~

#> x1 1.000

#> x2 2.213 0.145 1.945 2.515 0.006 normal(0,10)

#> x3 1.847 0.156 1.552 2.166 0.006 normal(0,10)

#> dem60 =~

#> y1 1.000

#> y2 1.443 0.168 1.118 1.777 0.001 normal(0,10)

#> y3 1.168 0.155 0.868 1.478 0.001 normal(0,10)

#> dem65 =~

#> y5 1.000

#> y6 1.260 0.188 0.921 1.659 0.012 normal(0,10)

#> y7 1.362 0.175 1.042 1.731 0.022 normal(0,10)

#> y8 1.384 0.182 1.056 1.770 0.023 normal(0,10)

#> dem60 =~

#> y4 1.500

#>

#> Regressions:

#> Estimate SD 2.5% 97.5% NMAD Prior

#> dem60 ~

#> ind60 1.379 0.348 0.706 2.069 0.001 normal(0,10)

#> dem65 ~

#> ind60 0.524 0.234 0.073 0.991 0.001 normal(0,10)

#> dem60 0.885 0.106 0.688 1.103 0.020 normal(0,10)

#>

#> Covariances:

#> Estimate SD 2.5% 97.5% NMAD Prior

#> .y1 ~~

#> .y5 0.330 0.410 0.132 1.739 0.006 beta(1,1)

#> .y2 ~~

#> .y4 0.216 0.675 -0.134 2.517 0.004 beta(1,1)

#> .y6 0.348 0.748 0.851 3.789 0.010 beta(1,1)

#> .y3 ~~

#> .y7 0.224 0.658 -0.207 2.378 0.005 beta(1,1)

#> .y8 ~~

#> .y4 0.069 0.448 -0.538 1.218 0.004 beta(1,1)

#> .y6 ~~

#> .y8 0.309 0.579 0.252 2.520 0.005 beta(1,1)

#>

#> Variances:

#> Estimate SD 2.5% 97.5% NMAD Prior

#> ind60 0.455 0.089 0.308 0.654 0.003 gamma(1,1)

#> .dem60 3.121 0.602 2.109 4.458 0.000 gamma(2,1)

#> .dem65 0.340 0.196 4.237 0.059 0.043 gamma(1,.5)

#> .x1 0.088 0.021 0.196 0.053 0.007 gamma(1,.5)[sd]

#> .x2 0.124 0.065 1.503 0.019 0.040 gamma(1,.5)[sd]

#> .x3 0.500 0.098 0.337 0.718 0.003 gamma(1,.5)[sd]

#> .y1 2.311 0.490 3.406 1.495 0.004 gamma(1,.5)[sd]

#> .y2 7.504 1.414 10.634 5.114 0.003 gamma(1,.5)[sd]

#> .y3 5.500 1.063 3.733 7.883 0.002 gamma(1,.5)[sd]

#> .y5 2.627 0.541 3.836 1.724 0.005 gamma(1,.5)[sd]

#> .y6 5.132 0.947 3.529 7.227 0.003 gamma(1,.5)[sd]

#> .y7 3.610 0.771 5.332 2.324 0.008 gamma(1,.5)[sd]

#> .y8 3.210 0.718 4.794 1.988 0.006 gamma(1,.5)[sd]

#> .y4 2.872 0.747 7.211 1.607 0.009 gamma(1,.5)[sd]Validation against MCMC

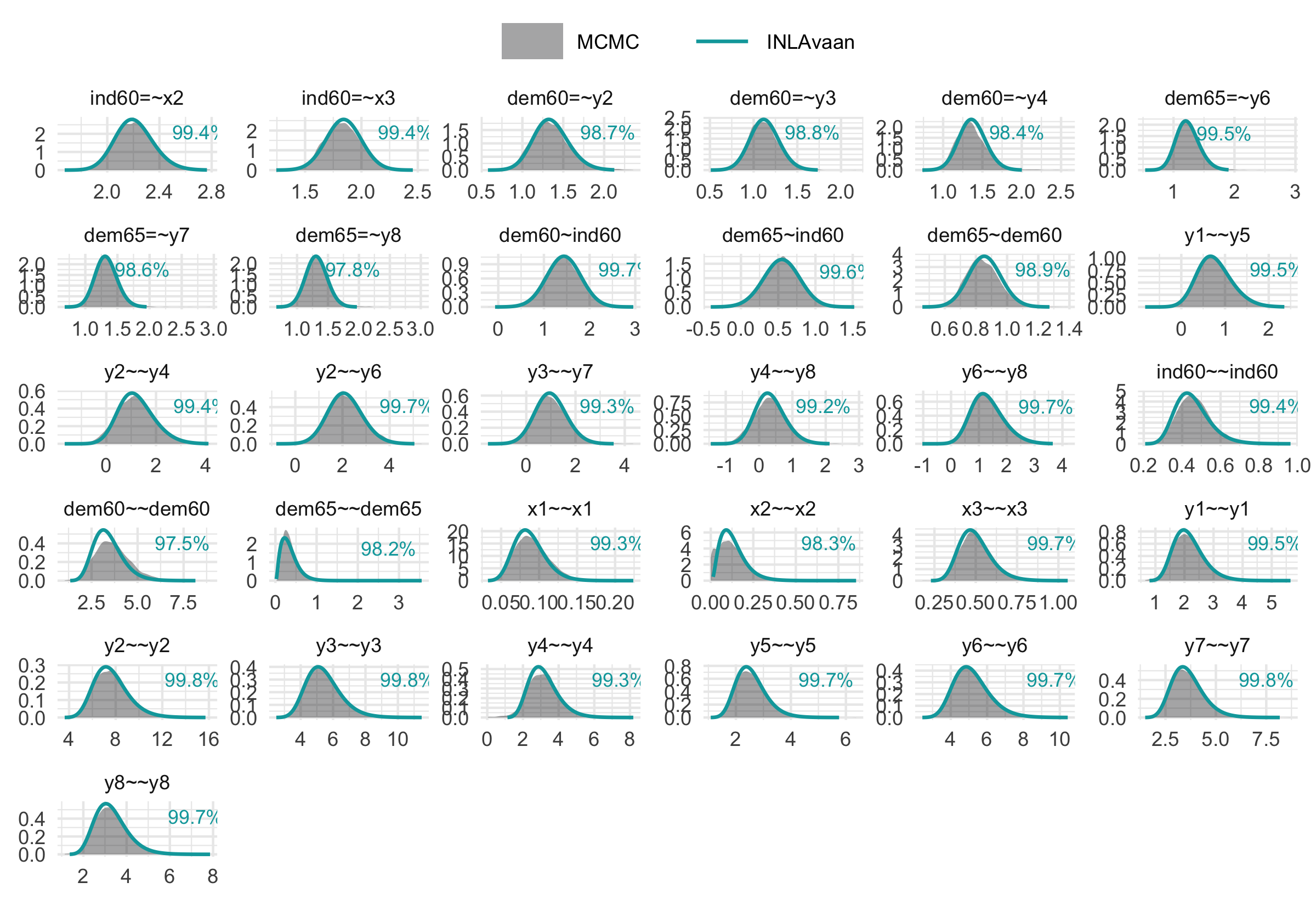

Computation speed is valuable only when accuracy is preserved. Our method yields posterior distributions that are visually and numerically comparable to those obtained via MCMC (e.g., via blavaan/Stan), but at a fraction of the computational cost.

The figure below illustrates the posterior density overlap for the example above. The percentages refer to the one minus the Jensen-Shannon distance, which gives a measure of similarity between two probability distributions.

# install.packages("blavaan")

library(blavaan)

fit_blav <- bsem(model, PoliticalDemocracy)

res <- INLAvaan:::compare_mcmc(fit_blav, INLAvaan = fit)

print(res$p_compare)

Installation

Install the CRAN version of INLAvaan using:

install.packages("INLAvaan")Alternatively, install the development version of INLAvaan from GitHub using:

# install.packages("pak")

pak::pak("haziqj/INLAvaan")Optionally2, you may wish to install INLA. Following the official instructions given here, install the package by running this command in R:

install.packages(

"INLA",

repos = c(getOption("repos"),

INLA = "https://inla.r-inla-download.org/R/stable"),

dep = TRUE

)Citation

To cite package INLAvaan in publications use:

Jamil, H (2026). INLAvaan: Approximate Bayesian Latent Variable Analysis. R package version 0.2.3. DOI: 10.32614/CRAN.package.INLAvaan

A BibTeX entry for LaTeX users is:

License

The INLAvaan package is licensed under the GPL-3.

INLAvaan: Bayesian Latent Variable Analysis using INLA

Copyright (C) 2026 Haziq Jamil

This program is free software: you can redistribute it and/or modify

it under the terms of the GNU General Public License as published by

the Free Software Foundation, either version 3 of the License, or

(at your option) any later version.

This program is distributed in the hope that it will be useful,

but WITHOUT ANY WARRANTY; without even the implied warranty of

MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

GNU General Public License for more details.

You should have received a copy of the GNU General Public License

along with this program. If not, see <http://www.gnu.org/licenses/>.By using this package, you agree to comply with both licenses: the GPL-3 license for the software and the CC BY 4.0 license for the data.